Speedstrap Playbook - Chapter 2

SpeedStrapping used to be a plan B; we now recommend it as plan A. This is part two of an extended guide for those striving to build with max speed to match the urgency of our climate challenge.

Living version of this Speedstrap Playbook here - comments welcome.

“Venture Capital doesn’t scale with more money.”

- Roelof Botha, October 2025 on Uncapped.

Playbook Table of Contents

Living version of this Speedstrap Playbook here. TOC corresponds to this post and links connect back to live doc.

Chapter 1 included:

Chapter two continues with:

Core Speedstrapping Principles

Speedstrapping is built on these foundational principles:

Context pre-requisite: Deep understanding of the customer and problem space

Revenue-first mentality: Develop business models that generate revenue quickly.

Customer validation: Use paying customers as market validation rather than investor opinions.

Maniacle focus on costs

AI from Day 1: Build with the assumption that AI copilots, no-code tools, and automated workflows are your first hires.

Diversified funding: Leverage non-dilutive capital alongside equity when possible.

VC when you dont need it: Aim for 1-2 equity rounds maximum, preserving founder ownership.

Default to non-dilutive

Financial discipline: Track key metrics fanatically and maintain short runways to profitability.

The speedstrapping approach aligns more closely with Strategy B or C from the traditional fundraising playbook, where the emphasis is on proving long-term viability rather than focusing solely on growth at all costs (Strategy A).

Pre-requisite

At the core of speedstrapping, as the name implies, is going fast. But this doesn't mean going blind. Raising money to fund the initial work and time required to get a deep customer understanding, is just as wasteful and costly as selling equity to fund years of research just to get to engineering feasibility. Founders who will succeed in speedstrapping, will already have invested the time needed to know the surface area of potential solutions that will have a higher likelihood of product market fit. This likely goes in hand with having a prototype or mockup that has helped facilitate a lot of customer conversations and discovery. Only after developing a deep customer understanding and building something basic can you get on the speedstrap timeline. If you raise capital just to fund the initial education of market discovery and engineering feasibility, then getting on a speedstrap pathway may mean getting existing investors aligned. Here’s how: share this playbook.

Revenue First

Unlike purely venture-backed companies, speedstrapped startups must focus intensely on revenue generation from the beginning:

Revenue Model Considerations

Choose models with faster cash conversion cycles

Subscription models with annual prepayment incentives

Upfront payments or deposits for services/products

Models with low CAC and quick customer payback periods

Pricing strategy

Price based on value, not just cost

Consider premium pricing with high margins

Test price sensitivity early and often

Use tiered pricing to maximize revenue per customer

Revenue acceleration tactics

Service components alongside products

Implementation or setup fees

Training or support packages

White-label or licensing options

The goal is to reach the revenue inflection point more quickly, where your business begins generating enough cash to reduce reliance on external funding.

Customer-Funded Growth

Converting customers into your primary source of cash, is a speedstrapping superpower:

Customer Funding Strategies

Prepayment incentives

Annual or multi-year contract discounts

Premium features for longer commitments

Service level guarantees for prepayment

Pilot-to-paid frameworks

Paid pilots instead of free trials

Clear conversion path from pilot to full deployment

Pilot fees applied to full purchase

Development partnerships

Co-development with key customers

Customer-funded feature development

Early access programs with premium pricing

Expanding customer relationships

Land and expand strategies

Cross-selling additional products/services

Referral incentives for existing customers

The goal is to make customers a primary source of growth capital, reducing reliance on external funding sources.

When Customers Are Your VC

“The best investors aren’t on Sand Hill Road—they’re in your inbox paying you for a product that works.”

Prepay customers don’t take board seats. They just want you to keep solving their problems.

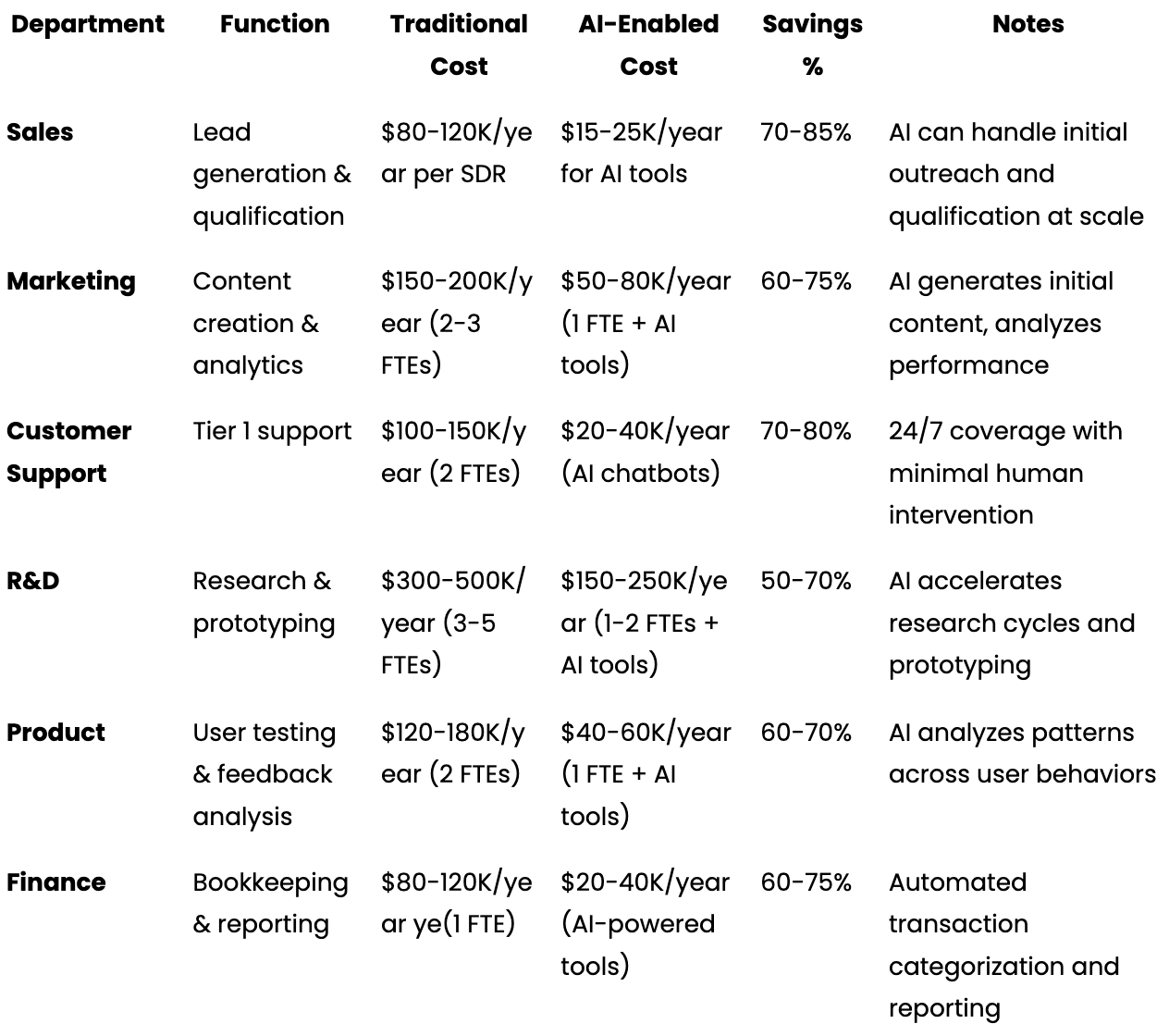

AI-Enabled Efficiency Gains

One of the most powerful reasons speedstrapping has become more viable in recent years is the dramatic efficiency improvements enabled by AI tools. These technologies allow founders to do significantly more with less capital and fewer human resources:

Estimated AI Cost Savings by Department

Recent data shows that 41% of marketing and sales teams generated 6-10% higher revenues following AI adoption, while reducing costs significantly. For example, advanced AI sales tools can now handle many aspects of prospecting, meeting scheduling, follow-ups, and even initial conversations that previously required dedicated sales development representatives.

The Speedstrapping AI Tech Stack

For founders looking to maximize efficiency while minimizing costs, consider these AI-driven tools by function:

Sales & Lead Generation

AI-powered SDRs (e.g., Actively, Artisan, Reply.io)

Conversation intelligence (e.g., Gong, Chorus)

Meeting scheduling and follow-up (e.g., Reclaim.ai)

Marketing & Content Creation

AI content generation (e.g., Jasper, Copy.ai)

Social media management (e.g., Lately.ai)

Marketing analytics (e.g., Oribi, Madkudu)

Product Development

AI-assisted coding (e.g., GitHub Copilot, Tabnine)

UX research and testing (e.g., Useberry with AI analysis)

Product analytics (e.g., Amplitude)

Operations & Finance

Automated bookkeeping (e.g., Vic.ai, Botkeeper)

Contract analysis and management (e.g., Lexion)

Expense management (e.g., Ramp, Airbase)

By strategically implementing these tools, speedstrapping founders can operate with the capabilities of a much larger team while maintaining significantly lower overhead costs.

DaaS instead of SaaS

A "Wizard of Oz" of “Mechanical Turk”, has long been used as a type of Minimum Viable Product (MVP) where users are given the impression of a fully functional product, while in reality, humans are doing the work behind the scenes (behind a curtain or under a chess table) to deliver the service or functionality.

This approach allows for rapid validation of a product concept without the initial investment in full-fledged technology. But this was never really designed to scale because the cost to deliver with humans was prohibitive. Now a critical new difference is that this first human-powered version can be extended into production with AI taking on some of the more expensive workflows.

This means more teams can transition from MVP to production without developing a full, standalone software. It does mean that the offering needs to be packaged differently - likely little or even no UX beyond email and chat and a focus on delivering a result. We shared some of what we’re starting to see in SaaS is dead. Long live DaaS.

The Ideal Capital Stack

A well-designed capital stack is critical to speedstrapping success. Think of your funding sources as layers that build upon each other. Getting to revenue sooner ensures access to more options as most credit product (ironically outside of venture debt) will depend on revenue.

Founder capital & early angels (15-25% dilution)

Personal investment

Friends and family

Inception or pre-seed funds

Early believers (angels)

Pre-seed/accelerator funding

It’s often the case that people who invest the smallest angel checks can outwork everyone else in terms of high quality introductions, so don’t focus too much on brand.

Strategic seed investment (15-20% dilution)

Preferably from investors who understand your industry

Smaller funds tend to be better aligned with founders, but even large funds may appreciate speedstrapping benefits to their returns

Do consider strategics since their increasingly active at this stage and can provide multiple types of value in areas from manufacturing to distribution

Target 12-18 months of runway with clear revenue milestones

Begin conversations with non-dilutive providers so their underwriting needs can be factored into seed milestones

Ranked lists like NFX Signal can be very helpful to get a first pass understanding of specializations by industry or technology.

Non-dilutive capital (0% dilution)

Customer prepayments and deposits

Grants and tax credits

Revenue-based financing

Supply chain financing

Venture debt (once revenue is established)

The key is to design your capital stack to minimize dilution while maximizing growth potential, using each funding layer strategically.

Optionality as Strategy

Speedstrapping isn't about saying “no” to growth venture forever. It's about saying “not until it makes sense.”

A speedstrapped company has more time and choice to optimize for equity partners who

Can add specific value in areas such as manufacturing or distribution

Enable liquidity for key common stock holder or earliest investors

Can help with other parts of the capital stack such as non-dilutive

Equity Fundraising Essentials

While speedstrapping minimizes equity rounds, the rounds you do raise must be strategic:

Pre-Seed/Seed Fundraising Strategy

Preparation

Develop a clear path to revenue (with timelines)

Create a minimalist deck focused on customer traction

Prepare detailed unit economics and path to profitability roadmap

Build a target investor list focused on industry expertise

Pitch focus areas

Revenue model and early traction

Capital efficiency and path to $1m-$2m ARR within 6-12 months

Customer validation and testimonials

Market opportunity and competitive advantage

Term optimization

Push for higher valuations based on current traction and speed-to-revenue potential

Consider SAFEs or convertible notes for flexibility

Minimize investor control provisions

Create founder-friendly vesting schedules

Remember, your early investors should be believers in the speedstrapping model, and not pushing for raising more than you need.

Non-Dilutive Funding Sources

A critical component of speedstrapping is maximizing non-dilutive capital:

Key Non-Dilutive Sources

Grants

Federal grants (SBIR, STTR, DOE, DOD, etc.)

State and local economic development programs

Foundation and corporate grants

International grants (EU Horizon, etc.)

Tax incentives

R&D tax credits

Hiring incentives

Regional development incentives

Clean energy and sustainability credits

Revenue-based financing

Percentage of revenue until repayment cap is reached

No equity or personal guarantees required

Flexible payments that scale with your business

Examples: Lighter Capital, Pipe, Clearbanc

Strategic partnerships

Joint development agreements

Corporate sponsorships

Co-marketing arrangements

Channel partner advances

Customer financing

Prepayments with discounts

Deposits on future products

Beta customer development fees

Long-term contracts with upfront components

Each of these sources can provide significant capital without diluting ownership, creating a multiplier effect on your equity funding.

We’ve been mapping out many of the debt and revenue based financing providers in our climate cap stack database. If there is anyone you think we’re missing from this database let us know here.

Financial Modeling & Finops for Speedstrappers

Calculating runway is a common default at the earliest stage to get to default alive. But this is insufficient when hardware is involved. In general software businesses can rely on higher margins to allow more time to adjust to mistakes or pivots.

Assuming similar revenue and team costs, the high-margin software business (80% margins) will have approximately 1.6 times as long to correct mistakes compared to the lower-margin business (50% margins). Quickness is required. Models can help.

High resolution modeling

Financial

Cash Runway: How many months you can operate before running out of money

Burn Rate: Monthly cash outflow

Gross Margin: (Revenue - COGS) / Revenue

Break-even Point: When revenue equals expenses

Unit Economics: Revenue and cost per unit sold

Break-even analysis

Receivables & Payables analysis

Customer

Customer acquisition cost

Churn Rate

NPS

Probability adjusted pipeline

Probability adjusted “traffic”

Product

Active Users: Daily/weekly/monthly engaged users

Feature Adoption: Usage of key product features

Growth

Monthly Recurring Revenue (MRR): For subscription businesses

Revenue Growth Rate: Month-over-month percentage increase

Conversion Rate: Visitors who become paying customers

Sales Cycle Length: Time from lead to closed sale

Common Growth VC Pitfalls and How to Avoid Them

One of the most counterintuitive aspects of startup building is that raising too much money can actually increase your chances of failure. Here's why.

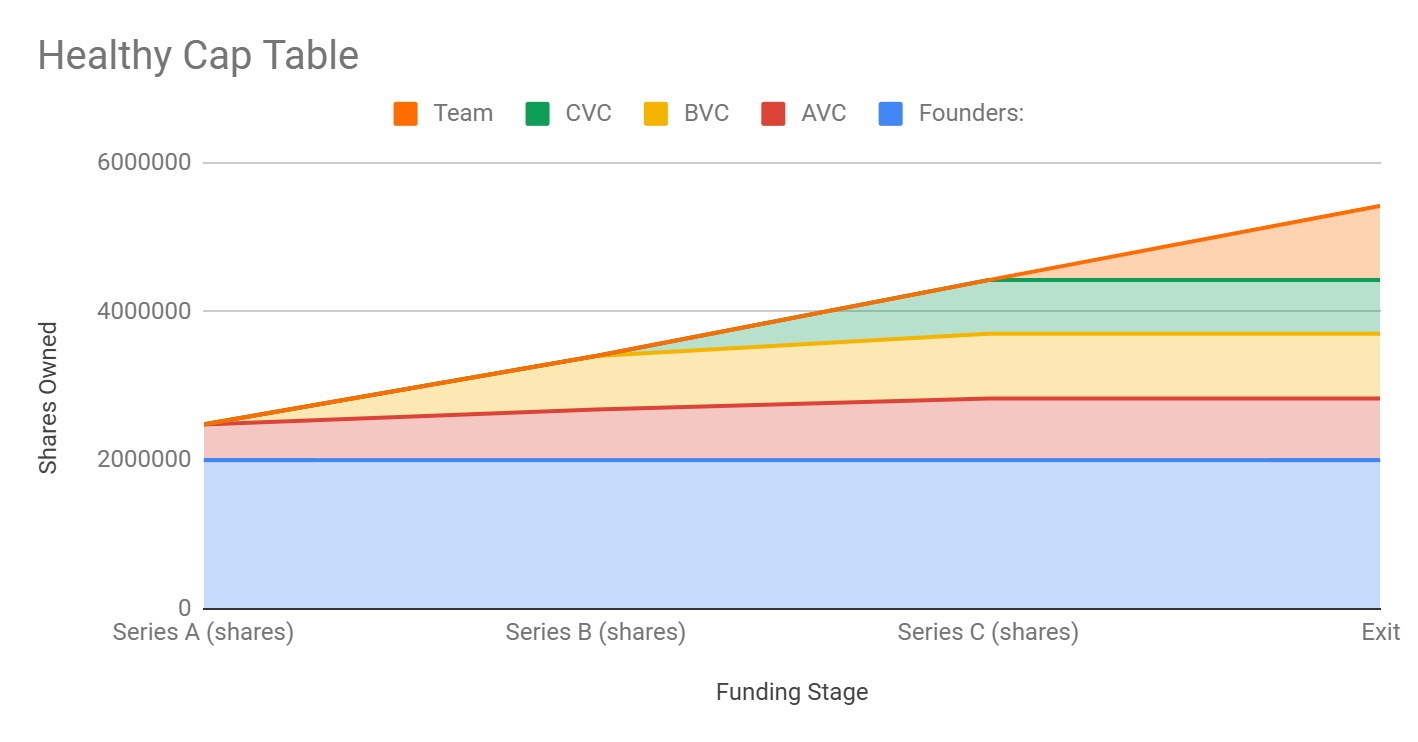

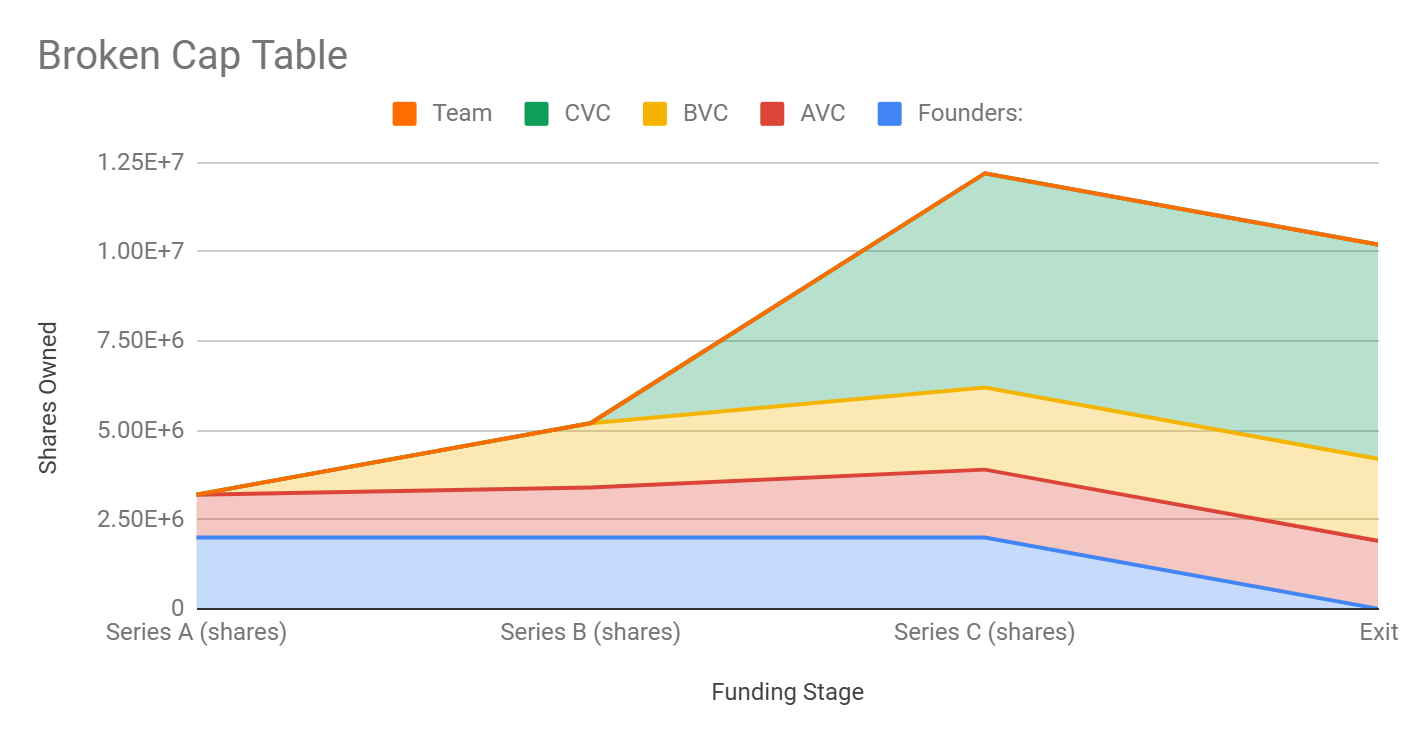

Broken cap tables

Let’s do some quick math. After series A, on average founders own 33%. After series D, usually under 10%. So basic math is roughly a $300m exit will be the same for founders who stop raising at series A versus founders who go to series D and achieve Unicorn status. But that’s only part of the story. Cap tables usually don’t break at series A, but they routinely break on the way series D - most of the cap table shenanigans of the last few years have been playing out at these stages.

There is an ideal that has been sold to founders that looks like the chart below. At each round, shares are added and sold. And then at exit, the math is simple - multiply the price per share by the shared owned.

But there are more common situations where the effective ownership as a result of things like liquidation preferences, for example, will mean that the founders and team get nothing.

Misaligned incentives

Large funding rounds create pressure for exponential growth that may not be sustainable or aligned with the business model. Investors who have put in significant capital may push for risky strategies to achieve the massive returns they need. Maybe things are taking 6 months longer or there is some regulatory uncertainty that would be best navigated by pausing.

Growth VCs can manage downside risks with a range of legal and other strategies. For example liquidation preferences ensure they get paid first, even if other investors and team members get nothing. And they can push for exits by offering a “bonus” to founders who go along with these exits that usually punish common stock holders aka the people who did all the work.

Inefficient spending

Having abundant capital often leads to undisciplined spending and premature scaling. This is especially true when teams are focused on rapid revenue growth and “grabbing” market share. Most of the 2021 class of unicorns fell into this trap and in the current surge of AI interest there are already signs this will be a failure mode.

There are upper limits on how quickly teams can grow. Rapid hiring creates management challenges that can slow decision-making and execution. Company culture becomes difficult to maintain when scaling too quickly.Teams become siloed, leading to communication breakdowns and misalignment.

It’s also true that throwing money at problems seldom yields creative solutions or deep insights.

Reduced flexibility

Higher valuations create higher expectations for future rounds. If market conditions change, companies can find themselves in a difficult "down round" situation. Extensive investor control provisions can limit strategic options, especially during challenging periods.

Speedstrapping helps avoid these pitfalls by keeping funding modest and focusing on sustainable growth through revenue rather than continuous fundraising.

Potential Speedstrapping Downsides

Feeling outraised

Funding announcements from others are an intentional distraction. Growth VC comes with an explicit promise that raising large rounds is part of a psychological game in which the announcement is meant to demoralize competition and suggest that VCs have picked a winner. It’s nonsense, mostly customers pick winners. And often customers aren’t paying much attention to the antics in VC.

Cash flow management

There is more pressure to understand cashflows. While it seems like equity bridges may be an option, there are a growing number of VC firms who skip these because very often bridges delay an inevitable outcome. So it’s unclear if access to more equity is in fact better.

Team building constraints

The main reason to raise is for hiring. With less cash, some potential hires will be out of reach because they have high minimum cash requirements. Even creative use of options and profit sharing wont be enough to solve this problem, but at the same time it’s often the case that people who don’t want to share risk in overall company performance, are not ideal candidates anyway.

Missing market timing

Pitfall: Growing too slowly in fast-moving markets

Solution: Identify key acceleration moments that require additional capital and be open to that source of capital coming from other providers beyond VC.

Remember that speedstrapping is not about avoiding investment entirely but using it strategically while prioritizing revenue-driven growth.

Case Studies from the Third Sphere Portfolio

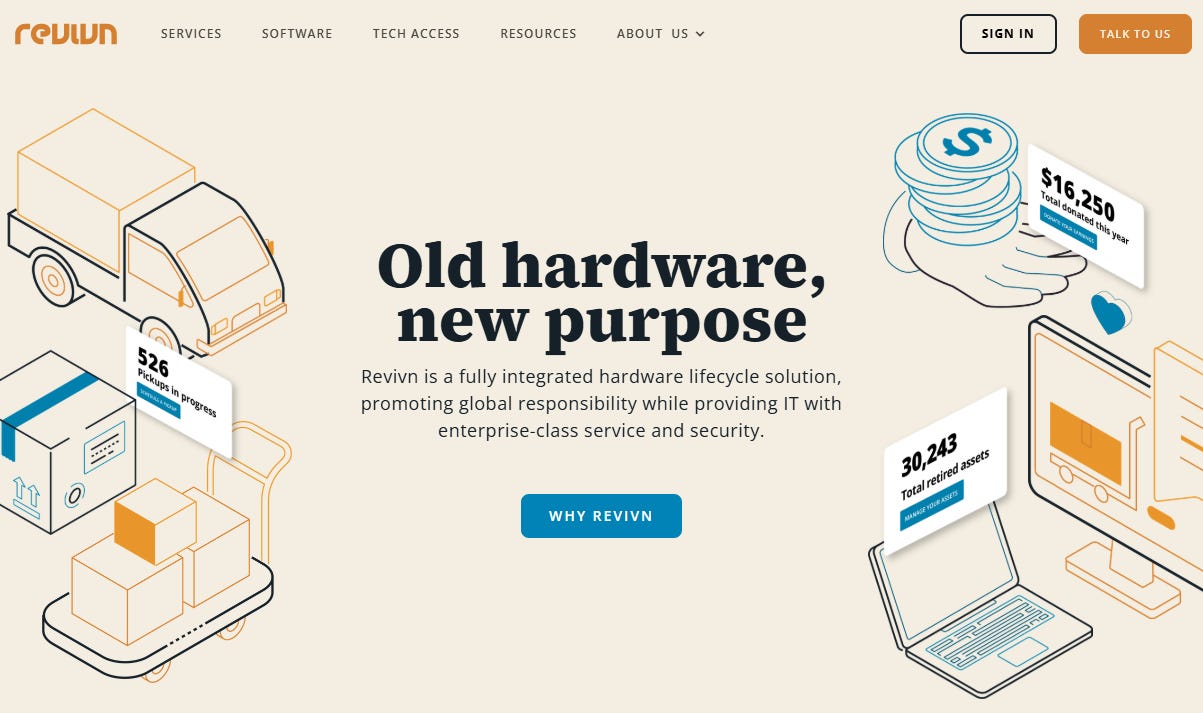

Revivn

Revivn keeps electronics out of landfill to increase reuse and avoid environmental and health impacts. They were one of the first speedstrapping success we’ve seen in the Third Sphere portfolio. They’re now one of the leaders in the circular economy.

Revenue Generation From Day One

Revivn prioritized securing early corporate clients, generating immediate revenue rather than building a product for months without income. This revenue-first approach provided essential operating capital and market validation.

Maniacle focus on costs

On an early investor update, the team joined the video call wearing winter coats. They were sitting inside, but explained that, to save money, they were working out of the unheated warehouse on a cold New York day.

Corporate Client Funding

Instead of relying heavily on investor capital, Revivn leveraged customer contracts with large organizations to finance their growth. These enterprise relationships provided stable, predictable revenue streams that supported expansion.

Strategic Use of Minimal Equity

Revivn began with modest pre-seed funding but waited to raise additional capital until after demonstrating strong unit economics. This patience allowed them to raise seed funding from a position of strength, maintaining greater founder control. They’ve been growing without needing to raise capital since.

Sustained Growth

Maintained impressive 2x growth year-over-year since founding. Successfully expanded from US operations into UK and EU markets

Revivn proves that even in logistics-heavy businesses with significant operational requirements, a speedstrapping approach focused on early revenue and minimal dilution can lead to sustainable global growth while keeping founders firmly in control.

More from Crunchbase profile.

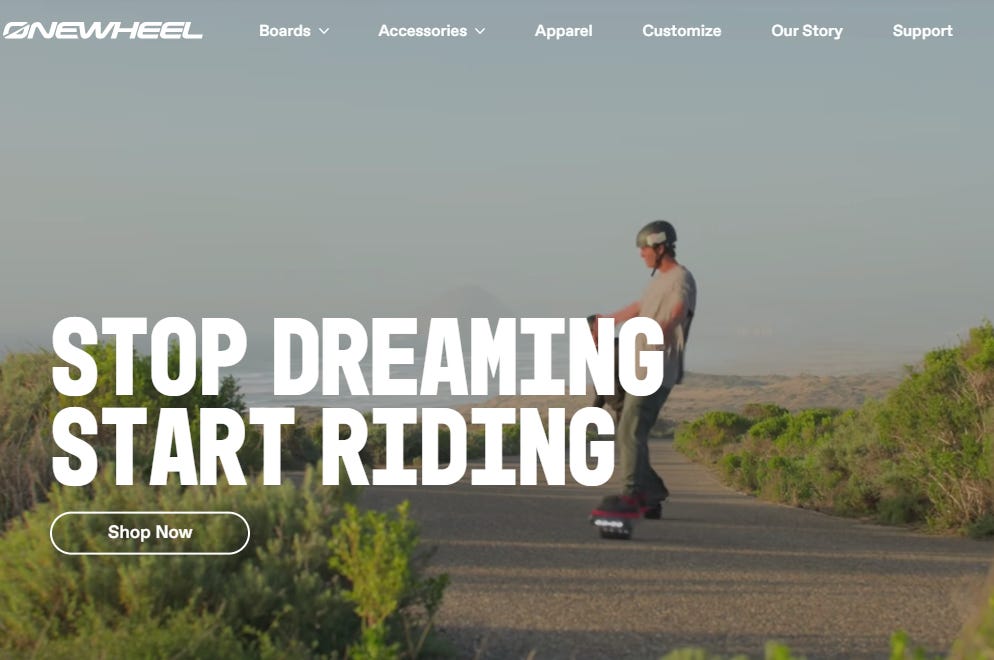

Future Motion (Onewheel)

How Future Motion inspired the creation of our speedstrapping framework.

Revenue-First Mentality

Future Motion implemented a premium pricing strategy with high margins from the beginning, prioritizing sustainable revenue over market share. This approach ensured each sale contributed meaningfully to their growth rather than requiring additional funding.

Customer Validation Through Crowdfunding

Rather than relying solely on investor opinions, Future Motion used crowdfunding to validate market demand for their electric boards. This provided both capital and proof of concept simultaneously. This approach transformed early adopters into both customers and evangelists.

Diversified Capital Stack

The company strategically combined initial equity funding with customer prepayments through crowdfunding. Early revenue and good margins, quickly unlocked credit lines.

Deep Financial Modeling

Future Motion developed a detailed forecasting model to enable what-if scenarios tightly linked to everything from inventory to website visits.

Future Motion's approach exemplifies that even in capital-intensive hardware businesses, the speedstrapping model can succeed. More about Future Motion funding and growth from Crunchbase

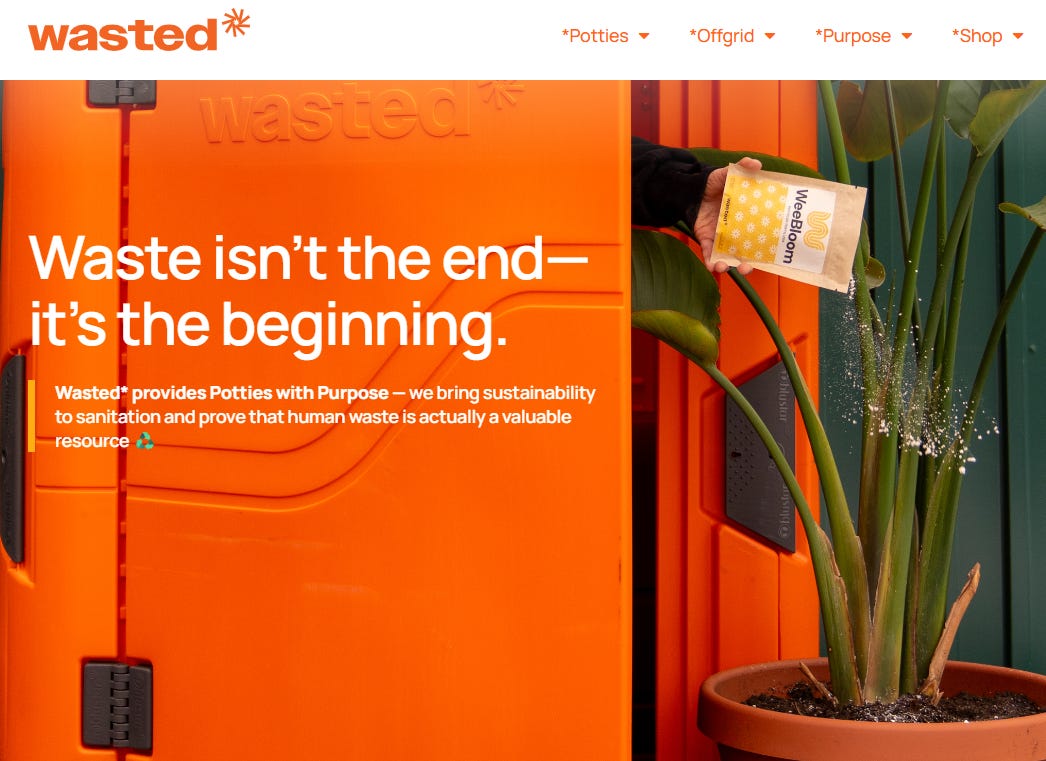

Wasted*

Wasted* is revolutionizing portable sanitation.

Revenue-First Mentality

Wasted* prioritized revenue generation from day one by securing early contracts with smaller construction companies and developing pilot projects with four major construction companies in Boston. This revenue-first approach provided essential operating capital and market validation.

Strategic Capital Stack

Wasted* began with targeted grant funding for sustainable waste management and developed their technology with paying pilot customers. They raised minimal equity, prioritizing strategic investors and then made use of non-dilutive capital to acquire assets like porta potties and vehicles for their collection service.

Detailed Financial Forecasts

Wasted* demonstrated strong financial discipline by creating detailed economic models that showed a path to profitability. They tracked key metrics such as projected gross margins (84%) and EBITDA margins (46% by 2028) reflecting the speedstrapping emphasis on tracking metrics fanatically and maintaining short runways to profitability.

More about Wasted finance and growth from

https://www.crunchbase.com/organization/wasted-426f

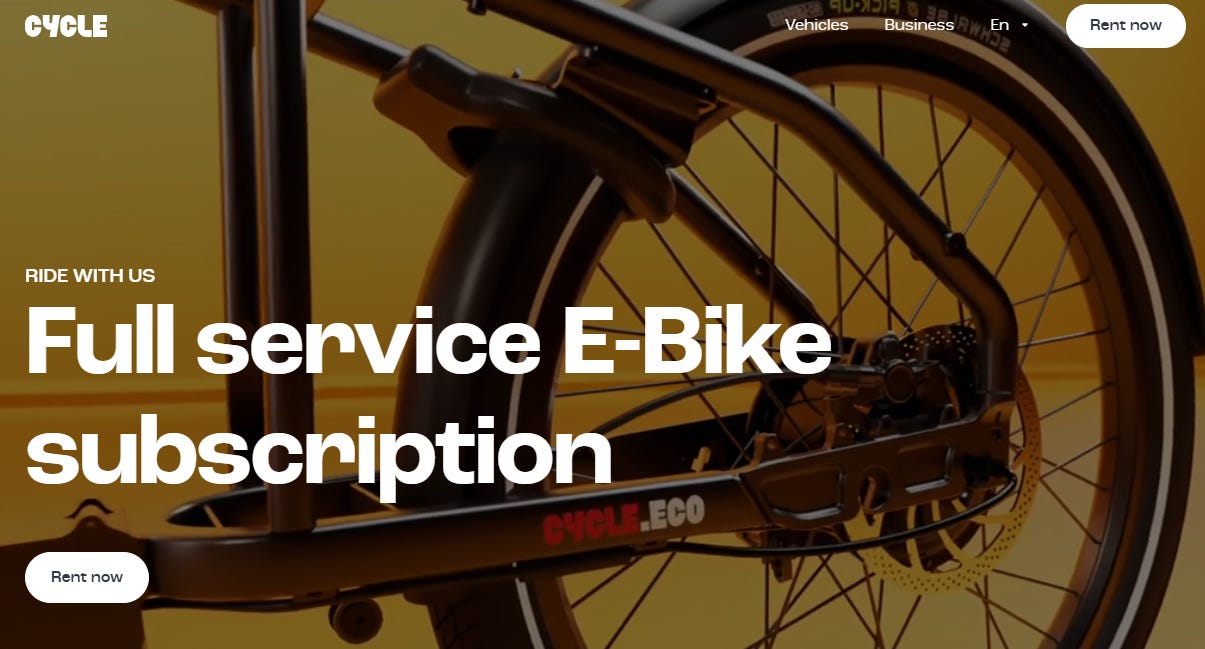

Cycle

Work closely with non-dilutive capital providers alongside early stage VCs.

Innovative Leasing for eBike Fleet Growth

Cycle’s B2B and B2C ebike leasing model eliminates the traditional capital and maintenance burdens from their customers. They're providing a great example of how to work with an asset finance partner to use off balance sheet leasing to enable organic growth and M&A.

Strategic Off-Balance Sheet Financing

Cycle developed a sophisticated partnership with asset finance providers to create an off-balance sheet leasing structure that enables them to scale their eBike fleet without the equity capital that would normally be required. This approach allows them to finance thousands of eBikes while maintaining minimal equity dilution.

Service-First Business Model

Rather than simply selling eBikes, Cycle transformed the product into a service with guaranteed availability. As described in our Climate Startup Playbook, Cycle turned eBikes into a cloud service. Like cloud services, businesses would prefer to have guaranteed availability of their fleet. If a bike fails for any reason, they don't need to worry. Within X minutes a new bike is available so operations can continue. This service model creates recurring revenue and strong customer retention.

European Market Leadership

Through their efficient capital strategy and service-focused approach, Cycle has become the largest in Europe in their category, demonstrating that speedstrapping can lead to market dominance without excessive equity funding. This growth is particularly impressive given traditional VCs' hesitation around hardware-heavy business models.

Growth Through Acquisition

Leveraging their innovative financing model, Cycle has pursued a roll-up strategy, expanding fleet size and geographic coverage through strategic acquisitions. Their off-balance sheet structure enables them to finance these M&As and acquisitions with minimal equity dilution, creating a virtuous cycle of growth and market consolidation.

Operational Excellence

Cycle's approach proves that with proper financial strategy, hardware startups can achieve scale while maintaining founder control and strong unit economics. Their success demonstrates how climate tech hardware companies can use innovative financial structures to overcome traditional capital intensity challenges that would otherwise break cap tables.

Swell Cycle

Sell surfboards and replica bones.

Unconventional Revenue Streams in Climate Hardware

Swell Cycle represents an innovative approach to speedstrapping by identifying unexpected revenue opportunities, particularly their strategy of selling replica dinosaur bones to fund their core environmental technologies.

Creative Funding Through Alternative Products

While pursuing their climate mission, Swell Cycle identified a high-margin opportunity selling replica whale bones. This unconventional revenue stream provided immediate cash flow that could be reinvested in their core technology development. This approach exemplifies the speedstrapping principle of finding creative paths to revenue that don't require dilutive capital.

Dual-Market Strategy

Swell Cycle operates in two distinct markets: their core recycled and bio plastics 3D printing business initially focused on boards and water craft and a more opportunistic market for replica whale and dinosaur bones. This dual-market approach provides stability through diversified revenue streams and creates financial resilience during technology development phases, which can often be capital-intensive in climate tech.

Leveraging Intellectual Property Across Domains

The company's expertise in materials science and manufacturing processes allows them to create high-quality replicas while simultaneously advancing their climate technology. This cross-pollination of intellectual property creates efficiencies in R&D and production that wouldn't be possible with a single-focus approach.

Capital Efficiency Through Rapid Feedback Cycles

The immediate revenue from replica sales provides not just funding but also valuable manufacturing and customer feedback cycles that inform their climate technology development. This rapid learning accelerates their path to market for climate solutions while maintaining founder control through self-funding.

Swell Cycle demonstrates that successful climate tech companies don't need to follow conventional paths to funding. By identifying high-margin adjacent opportunities and leveraging cross-market synergies, they've created a self-sustaining engine for growth that preserves equity and independence while advancing their climate mission.

Cases beyond Third Sphere Portfolio aka OG Speedstrappers

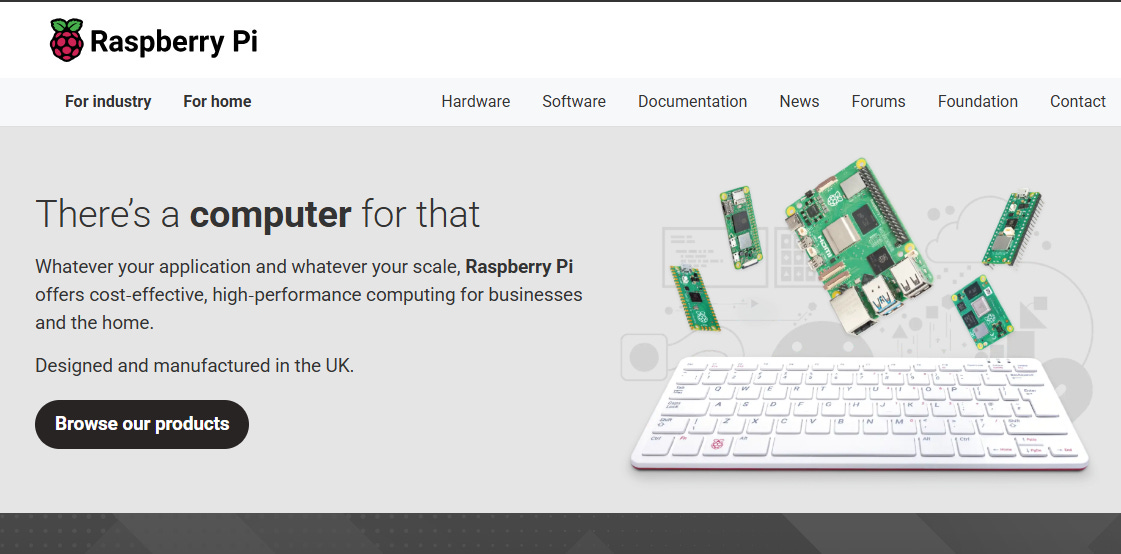

Raspberry Pi

Test demand by asking customers to pre-order.

Revenue-First Mentality

From its inception, Raspberry Pi focused on selling low-cost computers directly to hobbyists, educators, and developers. This direct-to-consumer hardware strategy prioritized early and recurring revenue over aggressive fundraising. The first version of the Raspberry Pi sold over 100,000 units within the first few weeks—providing immediate proof of product-market fit and a strong revenue base without requiring large equity rounds.

Customer Validation Over Investor Signaling

Raspberry Pi didn't seek early VC backing to validate its idea. Instead, it proved traction with paying customers who evangelized the product through online communities and educational forums. This grassroots enthusiasm formed the foundation of a robust, recurring customer base that supported iterative product development without major capital requirements.

Capital Stack Strategy

Raspberry Pi Foundation began as a nonprofit and used a hybrid capital approach. It reinvested operating surpluses into R&D while establishing the for-profit subsidiary Raspberry Pi Trading to commercialize the product. Their capital stack included:

Minimal early equity funding (mostly from mission-aligned angels)

Customer revenue as the primary growth engine

Grants and education contracts for deployment in public school systems

This model minimized dilution while aligning with their mission and growth objectives.

Financial Efficiency and AI-Enabled Expansion

Although early growth predated widespread use of AI, Raspberry Pi has since integrated AI-focused capabilities into its latest boards, enabling applications in computer vision, robotics, and edge computing. This attracts new revenue from the growing ecosystem of AI builders and hardware tinkerers. By leveraging open-source communities and maintaining lean operational costs, Raspberry Pi has achieved strong gross margins on its core product line.

Raspberry Pi is a blueprint for mission-driven speedstrapping: early customer revenue, nonprofit/public sector leverage, and strategic reinvestment rather than dilution-fueled scaling.

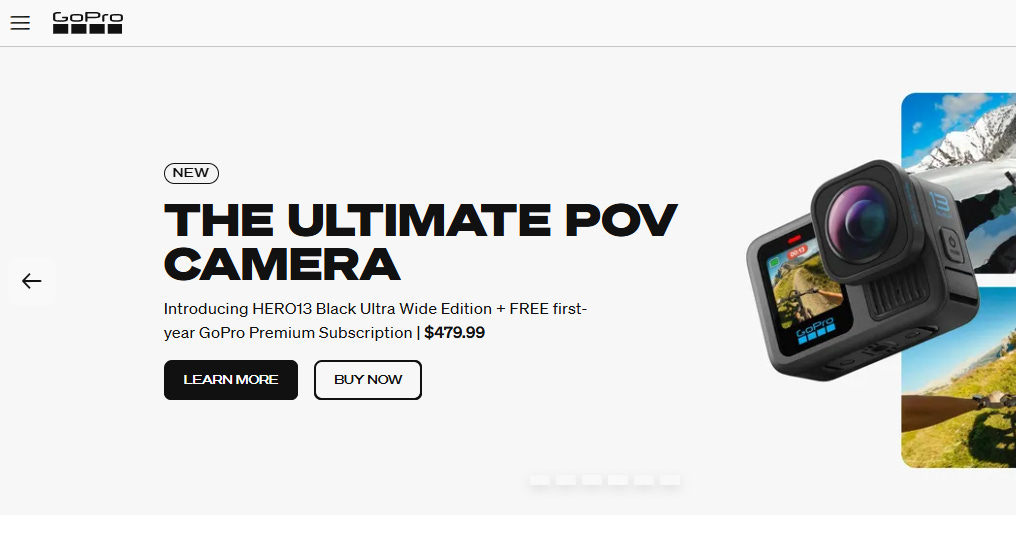

GoPro

Action Camera Icon Built on Cash Flow, Not VC

Early Revenue and Bootstrap Roots

Nick Woodman founded GoPro in 2002 and self-funded the company with savings and a small loan from family. Instead of chasing early equity funding, GoPro focused on building a product and selling it directly to consumers at action sports events and surf shops. By 2004, GoPro had generated over $150,000 in sales, and within a few years, they surpassed $10M in revenue—all before raising institutional funding.

Customer-Funded Growth

Rather than relying on investors, GoPro turned its early customers into evangelists. Each sale provided not only margin but also free marketing via user-generated content. The company’s early sales strategy created a flywheel of product feedback, loyalty, and organic growth. Their distribution expanded rapidly through partnerships with REI, Best Buy, and other major retailers—without requiring large marketing spend or VC cash.

Strategic Use of Minimal Equity

GoPro eventually raised a small Series A, but only after establishing significant sales volume and profitability. When Sequoia Capital finally invested in 2011, GoPro had over $100M in revenue. This delayed funding allowed the founder to maintain majority ownership through IPO, raising $88 million total before then.

Hardware Margins and Financial Discipline

Despite being a hardware company, GoPro operated with margins comparable to premium software businesses. High-margin accessories, direct sales through its website, and lean manufacturing partnerships in China supported a gross margin north of 40%. These strong unit economics were only possible because of the company’s relentless focus on cost control and premium pricing.

GoPro proves that hardware companies can follow a speedstrapping path—building a global consumer brand with minimal dilution by focusing on gross margin, brand loyalty, and cash flow discipline.

Conclusion

The Speedstrapping Playbook presents an alternative to traditional venture capital by championing a strategy that combines early revenue generation with minimal equity dilution. Rather than chasing metrics to unlock large VC rounds, speedstrapping encourages founders to focus on sustainable, customer-funded growth, leveraging tools like AI, grants, strategic partnerships, and non-dilutive financing options such as revenue-based financing or supply chain credit.

Speedstrapping is especially powerful in today’s landscape, where AI dramatically reduces the cost to build and operate, and where private credit is increasingly available in forms such as revenue or asset-based finance. By maintaining financial discipline and reaching profitability earlier, founders preserve control and reduce reliance on volatile funding cycles, ultimately retaining greater ownership and optionality and avoiding the zombie status associated with growth stage companies that have zero margin for error.

This playbook outlines how to build with AI from day one, validate with paying customers instead of investors, and model finances with a laser focus on margins, burn, and unit economics. Speedstrapping is no longer the Plan B but the Plan A choice to increase chances of successful impact and financial outcomes.

Resources and Tools

AI Tools

Third Sphere AI for Startups - Resources Page

Financial Management

Runway calculators: Pulley, Carta

Cash flow forecasting: Float, Flightpath

Revenue modeling: Causal, OnPlan

Pro-forma & Fin-ops: Perl Street

Non-Dilutive Funding

Grant databases: GrantWatch, SBIR.gov

Revenue-based financing: Pipe, Clearbanc, Lighter Capital

Credit Providers: Third Sphere Credit DB

R&D tax credits: MainStreet, Neo.tax

Customer Funding

Payment processors with advances: Stripe Capital, Square Capital

Prepayment platforms: Recharge, Bold Subscriptions, Kickstarter

Contract management: PandaDoc, DocuSign

Community Resources

Peer networks: Indie.vc community, Calm Company Fund, Third Sphere

Learning resources: Earnest Capital guides, Tiny Seed Tales podcast

Conferences: MicroConf, SaaStock Bootcamp