SpeedStrap Playbook - Chapter 1

SpeedStrapping used to be a plan B; we now recommend it as plan A. This is the beginning of an extended guide for those striving to build with max speed to match the urgency of our climate challenge.

Working version of our extended Speedstrap Playbook here - this is a living document and comments are welcome.

“...my gut is we have a problem. The system as it exists today promotes less liquidity, less traditional, high quality company building and way higher burn rates. That’s just not a great combination from my perspective.”

- Bill Gurley, June 2025 on Invest Like The Best.

Overview

We’ve made major revisions to our fundraising playbook four times over the last decade, but this will be by far, the biggest change. Speedstrapping used to be a plan B for those who couldn’t find the path to growth VC. But now we believe speedstrapping should be plan A for founders, even those that work in “capital intensive” businesses.

VC has bifurcated into megafunds and sub $100m funds, with growth VC taking on more specialized roles. The Megafund model is unproven - it’s unclear if enduring tech companies can consume vast amounts of equity funding in strategies that tend to focus on “pay to win”. At the same time private credit now offers a new capital option that matches all of VC in AUM, but very few founders and VCs have a grasp of how to access. And all of this while AI is likely cutting in half the payroll portion of finding product market fit.

Speedstrapping is a strategic approach to building your startup that balances minimal equity fundraising (typically pre-seed, seed, and perhaps pre-A/seed+) with a focus on rapid revenue generation and accessing non-dilutive capital. This approach allows founders to maintain greater control of everything from culture to exit scenarios and avoid some of the undesirable outcomes we’ve seen when teams have raised too much equity.

Speedstrapping’s focus on rapid paths to revenue might seem incompatible with some types of company building like those producing hardware intensive products. However, we’ve found within our portfolio, many of our best companies are not just building software and are already following the speedstrapping path. Some of the most valuable companies in the world today focused on early revenue. It not only provides the strongest customer signal, but also unlocks non-dilutive finance.

Best of all, there is little downside to speedstrapping, as high growth, efficient companies have never struggled to find growth equity. But the downsides of optimizing for growth equity too early have become ever clearer - seemingly small setbacks quickly lead to huge dilution via flat and down rounds, usually punishing employees, early investors and founders.

Playbook Table of Contents

Living version of the extended Speedstrap Playbook here. TOC corresponds to this post and links connect back to live doc.

Chapter 1:

Why Now: LLMs, Private Credit, VC Barbell & Corporate Partnerships

1. LLM-Enabled Productivity

2. The MegaVC Paradox: More Capital ≠ Better Outcomes

3. Growth VC: From Default Setting to Specialized Use Cases

4. Private Credit Surge: Much More Non-Dilutive Capital Available

5. Corporate Partners: From second choice, to real partners

Following chapters will feature:

Core Speedstrapping Principles

Equity Fundraising Essentials

Common Growth VC Pitfalls and How to Avoid Them

Potential Speedstrapping Downsides

Case Studies from the Third Sphere Portfolio

Cases beyond Third Sphere Portfolio aka OG Speedstrappers

Conclusion

Resources and Tools

Why Now: LLMs, Private Credit, VC Barbell & Corporate Partnerships

AI is dramatically reducing costs to build. At the same time large pools of new capital are available via private credit. Megafund-VC models seem good for LPs, but are not well aligned with founders.

1. LLM-Enabled Productivity

AI tools have fundamentally changed what small teams can accomplish, creating unprecedented efficiency gains:

Workforce multiplication effect: Current research already shows AI can increase productivity by 40-66% on average across various business functions. A single team member using AI effectively can now do the work previously requiring 2-3 employees. For example, a Nielsen Norman Group study found that generative AI enables employees to write 59% more documents than those working manually.

Dramatic cost reductions: AI has slashed costs across critical business functions. E-commerce teams that have integrated AI into workflows save an average of 6.4 hours per week per employee. For customer support, AI has shown to increase issue resolution by 14% per hour while reducing handling time by 9%.

Democratized access to specialized capabilities: Startups can now access enterprise-grade capabilities in marketing, sales, design and development that previously required large teams or expensive agencies. Even with moderate AI adoption, staff report an 80% improvement in productivity.

Lower capital requirements: The AI productivity revolution means startups can reach significant milestones with significantly less investment than was required just 5 years ago. AI integration is creating "20% to 30% gains in productivity, speed to market and revenue" across various business functions.

Time-to-market acceleration: Companies using AI tools can now develop, test, and launch products faster. In a nationally representative survey conducted in November 2024, workers using AI saved an average of 5.4% of their work hours, which translates to about 2.2 hours per week for a full-time employee.

For speedstrapping founders, this means you can operate with a fraction of the capital and team size that would have been required just a few years ago, while still competing effectively against larger, well-funded competitors and incumbents.

2. The MegaVC Paradox: More Capital ≠ Better Outcomes

While AI is making it possible to do more with less, the venture capital landscape has moved in the opposite direction:

Pay to win: Investors with large funds often push founders to raise using fear tactics? What if their competitors raise? While it’s too early to call results from AI investment we know that more than 80% of the 2021 era unicorns are likely zombies with funds holding these companies at wide ranging valuations. Claude.ai estimates funding explains up to 33% of outcomes post series A, over the last 20 years.

Rapid VC fund size expansion: In 2024, the venture capital market began to rebound after a correction phase, with AI attracting record levels of funding—$131.5 billion, representing one-third of all venture capital investment that year. In the same year, the top 30 funds secured 75% ($57 billion) of the year's total, with just nine funds raising 46%—approximately $35 billion.

Pressure to deploy larger checks: Despite fundraising declining by 24% year over year to $589 billion in 2024, VC dealmaking rebounded significantly, rising by 14% to $2 trillion, making it the third-most-active year on record by value. Larger funds need to write larger checks to move their fund metrics, creating pressure for startups to take more money than they may need.

Diminishing returns on excessive capital: While raising a lot of cash may help a company grow, raising more capital than needed leads to some real challenges like trying to hire rapidly or to deploy into inefficient market spend, often without any material improvement in moats.

Increased investor control: As ownership becomes more diluted through multiple funding rounds, founders and early investors have less control over how the company is run, which can be problematic if new investors have different goals for the company. Misalignment in cap tables, quickly becomes a distraction from company building and slows down decision-making often at critical moments in market expansion.

3. Growth VC: From Default Setting to Specialized Use Cases

In earlier versions of our fundraising guide, growth VC as defined by series A, B, C, D etc. was presumed to be the destination. No longer.

LP’s First: Fund sizes often reflect LP preferences for their minimum commitment sizes that is in turn a function of administrative preferences. A large institution cannot or will not manage more than a few GP relationships, so this begins to shape minimum fund sizes. That has nothing to do with actual demand from founders to build companies.

AI $$$ vs built with AI $: In 2025, investors want as much exposure as possible to AI and most have chosen a few direct strategies that tend to exclude a lot of businesses that are using AI to build differently. It’s a bit like focusing on the glass, cameras, cloud, GPS and other components of the iPhone, but not being excited about Apple. Or choosing browsers, servers and payment platforms, when you could have selected Amazon.

Distressed hangover: As the markets corrected from the excesses of 2021, down and bridge rounds proliferated resulting in aggressive renegotiation of valuations, often at the expense of early investors and common stock holders. Some correction was warranted but there is a sense among many founders and early investors that many growth VCs are not going to be great partners if things get hard. That wasn’t true before 2021.

Getting to bankability: For a subset of startups, Private credit is great, but likely unavailable before proving out the first N of a Kind (NOAK) deployments. Getting to N deployments is a place where growth VC could shine but there are still very few funds positioning for this opportunity and not much evidence that this will outperform strategies such as joint ventures with corporates as a path to proving out NOAKs.

4. Private Credit Surge: Much More Non-Dilutive Capital Available

While VC has been expanding AUM, Private Equity is turning into private credit, adding options for early stage companies far beyond venture debt.

Rapid private credit expansion: Institutional investors are allocating more into alternative investments. Within a decade, debt grew from $500b in AUM to $1.6t. That’s closing in on total for all stages of VC. Given the more predictable liquidity profile, there is no reason to expect this trend to slow.

Improving sourcing: VC has had a huge lead in building brands which has simplified sourcing/origination. There are exceptions like SVB who focused on venture debt and worked closely with the VC ecosystem, but we’re starting to see more founders and lenders finding each other. As AI takes share from search, this will accelerate.

Automated underwriting: a significant friction point for founders has been figuring out what lenders need. Even CFOs haven’t needed to worry much about this because most worked on software and could focus on equity, but as these skills are relearned, AI tools are making it easier for founders to prepare and for lenders to offer quick feedback.

5. Corporate Partners: From second choice, to real partners

More Than Big Tech: OpenAI and Microsoft make news for the myriad ways they work together. However incumbent leaders across multiple industries are looking to startups for an edge or even a substantial part of their future in areas ranging from HVAC to Micromobility.

Early Stage Hardware Is Defined By Partners: In particular, key suppliers ensure that teams can deliver on promised price and performance long before they have their own production capabilities.

Full stack finance: unlike traditional VC, corporate partners have the capacity to go far beyond equity. Everything from extending payment terms to setting up off-balance-sheet structures.

Additional Signal: When customers and partners also invest, this can be seen positively by other investors, provided there is a clear understanding of what rights and terms have been extended that will not interfere with future funding or exit scenarios.

Together, AI, corporate partners, VC changes and private credit growth, creates a unique opportunity for disciplined, capital-efficient founders. While competitors may be encouraged to overspend on growth at all costs, speedstrappers can build more sustainable businesses that maintain founder control and ultimately may deliver better risk-adjusted returns. Just ask the founders of the 1,000 or so Zombie Unicorns.

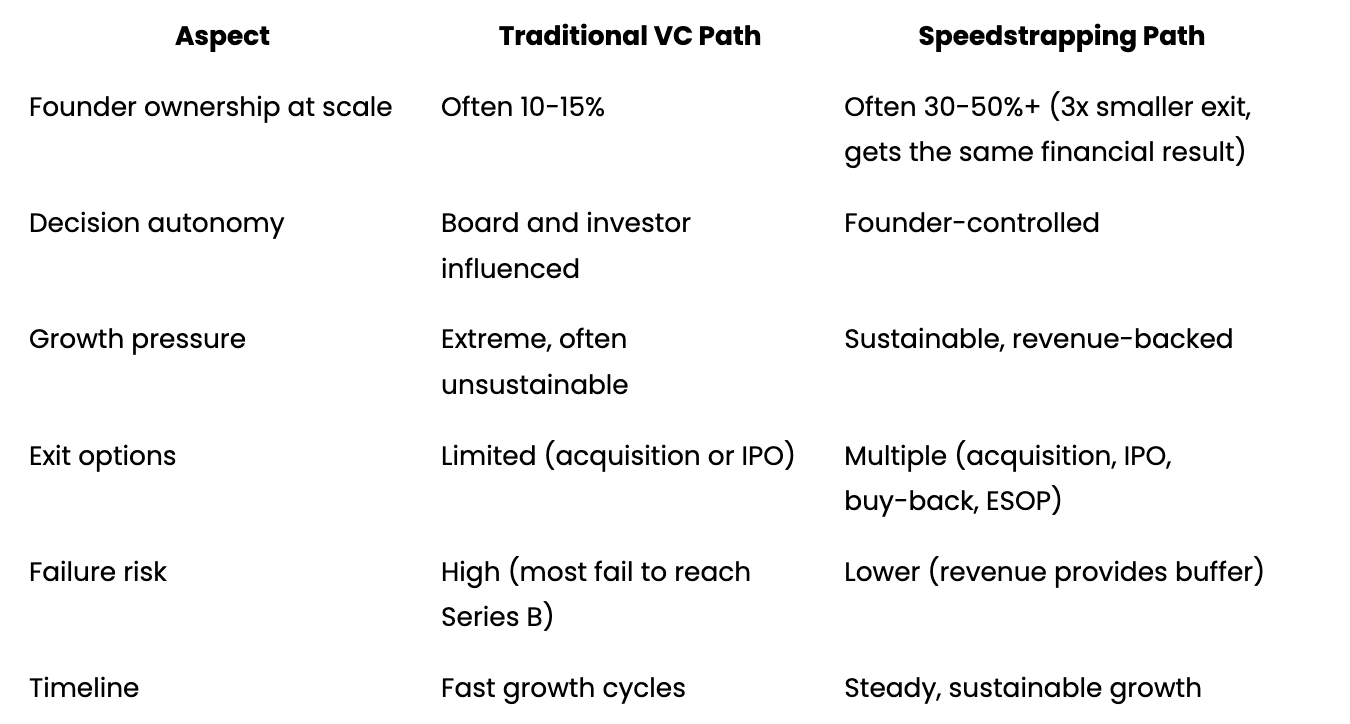

The Speedstrapping Advantage

Comparing traditional VC-backed vs. speedstrapped approaches:

Speedstrapping provides founders greater control over their destiny while creating optionality. A successful speedstrapped company can always pursue traditional VC rounds later, but from a position of strength.

Founder Archetypes Who Thrive with Speedstrapping

Former operators who want more control

Repeat founders avoiding hypergrowth pressure

Mission-driven builders optimizing for durability

Climate/AI-native entrepreneurs focused on margin-rich, cap-table light

Next:

We’ll be launching the rest of this playbook during our New York Climate Week discussion on September 23rd:

SpeedStrapping Climate Tech: Third Sphere's Opening Session & Presentation at NYCW [Space Limited]